At Health Launchpad, we help companies with their US market entry strategy. One of the first areas they want help with is understanding the US healthcare market segmentation. How is this $3.6 trillion market organized? What the healthcare industry market segments, how big are each, and what are the characteristics.

This is a complicated issue, and there are many different ways of looking at it. In this post, I will share how we look at the US healthcare market. I will then drill down on how the provider segment, in particular, operates. This is the most important healthcare industry market segment in many respects.

In summary, I will provide a 50,000-foot view of the $3.6 trillion markets, a 20,000-foot view of the provider segment, a 10,000-foot view of the hospital market, and then 1,000-foot views of sub-segments of that market.

I hope that after reading this, you will have a basic orientation to the US healthcare market.

50,000 Foot View – The US Healthcare Market Segmentation

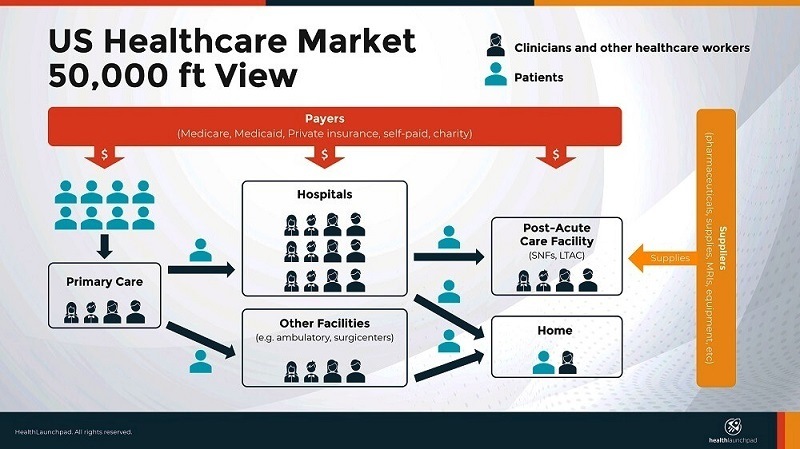

In simple terms, there are three major healthcare industry market segments within the U.S. market: The Provider market, the Payer market, and the Supplier market.

The provider market accounts for about two-thirds of the $3.6 trillion US healthcare market. The remaining third is split approximately evenly between the payer and supplier markets.

I have always found that the best way to understand the US Healthcare market is to look at it through the eyes of a patient.

Download the US Healthcare Segmentation White Paper

Download the US Healthcare Segmentation White Paper

How the US healthcare Provider and Payer market is segmented, size of each segment and how each segment is structured.

⚕️1. The US Healthcare Market Segmentation – Provider Market

This diagram shows a typical patient journey, and how they encounter the various parts of the healthcare market. They will interact most with the Provider Market.

For the sake of this scenario, this is a patient who will undergo a hip replacement. The start of the journey is likely to begin in a physician’s office.

The physician will then refer the patient for a medical procedure. This may happen in a hospital or surgical center. These ancillary facilities are also known as Ambulatory Surgery Centers(ASC)

After successfully undergoing the procedure, and the patient is ready, the physician discharges the patient for rehabilitation. In most cases, this happens at home.

However, in certain cases, and especially where there are complications, the patient may be transferred to a post-acute Care Facility, typically a Skilled Nursing Facility (SNF).

In rare circumstances, and in the most acute cases, the patient is taken to a Long-term Acute Care (LTAC) Facility for more specialized care.

At home, the patient may be under the care of either a home care aide or a visiting nurse.

Throughout the journey, the patient will interact and be supported by the other two healthcare industry market segments – The medical / healthcare Payer market and the healthcare / medical Supplier market.

⚕️2. The US Healthcare Market Segmentation – Payer Market

The payer market provides payment for some or all patient’s procedures, supplies, and medications. The market is made of both private and public institutions.

The private payers consist of health insurance firms such as United Healthcare and Aetna among others.

The public Payers Market includes Federal and State entities. The public payers include Federal and State.

The biggest public payer is the Federally run Medicare, and this is mostly for people of the age of 65. Medicaid is for lower-income Americans. It is funded by the States and subsidized Federally.

⚕️3. The US Healthcare Market Segmentation – Supplier Market

The second and last of the healthcare industry market segments that patients interact with is the healthcare Supplier Market.

The market included pharmaceuticals, medical supplies, devices, and everything else that patients may need for treatment or to manage their conditions.

—————————

20,000 Foot View – The Healthcare Provider Market Segmentation

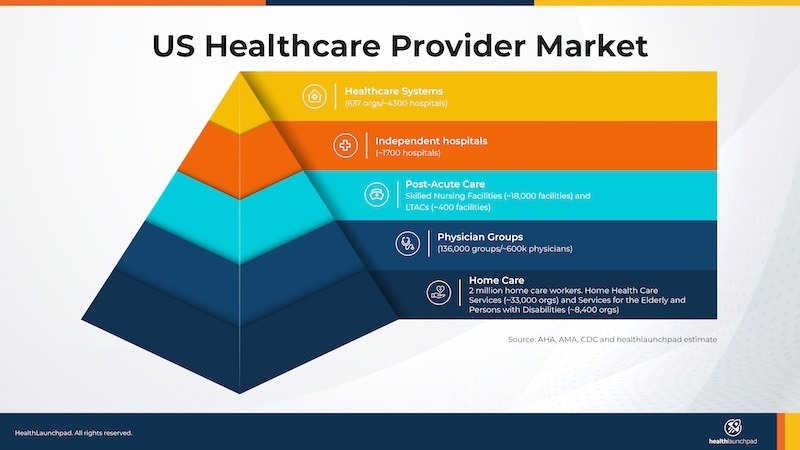

Now let’s take it down a level and focus on the US healthcare provider market segment. In simple terms, this is broken into hospitals, post-acute care facilities, physician groups, and homecare organizations.

The image at the top of this post depicts the respective size of each in terms of the number of organizations.

⚕️1. Hospital-based Organizations

According to the American Hospital Association, there are 6,090 hospitals in the US. The vast majority are part of 637 multi-hospital system organizations. We will explain these in more detail later. There are still around 1,700 independent hospitals

⚕️2. Post-acute Care

There are two types of post-acute facilities. The majority are Skilled Nursing Facilities (SNFs). In addition, there are Long-term Acute Care (LTAC) Facilities,

There are approximately 18,000 skilled nursing care facilities in the US. Many of these operate under large organizations such as Genesis, Heartland ManorCare, and Lifecare Centers of America.

There are around 400 LTAC Facilities, many owned by large organizations such as Kindred Healthcare.

⚕️3. Physician Groups

There are 136,000 physician groups in the US according to the American Medical A

ssociation. They employ over 600,000 physicians. (There are another 300,000 physicians working for healthcare systems).

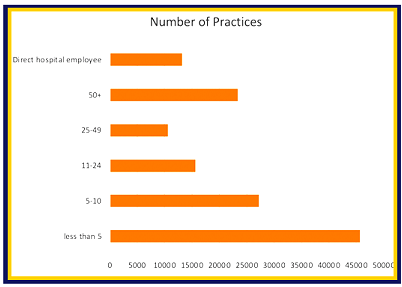

As this graphic shows, the majority of practices employ fewer than 10 physicians. However large physician groups with more than 50 physicians are a close third.

About 43% of these physicians work in single-specialty groups, 15% in solo practice, and 25% in multi-practice groups. The rest work in hospitals or other organizations such as payers or the Government.

⚕️4. Home Care

According to PHI National, there are more than 2 million home care workers. These include personal care aides, home health aides, and nursing assistants.

Home Care workers work for Home Health Care Services institutions or provide services for the Elderly and Persons with Disabilities.

Home Health Care Services include Home Health Care Agencies, Visiting Nurse Associations, In-Home Hospice Care Services.

Services for the Elderly and Persons with Disabilities include Non-Medical Home Care Providers, Homemaker Service Providers, Self-help Organizations, Activity Centers for Older Adults and People with Disabilities, Companion Service Providers, Adult Day Care Centers

There are 33,347 firms registered as Home Health Care Services and 8,405 firms registered as Services for the Elderly and Persons with Disabilities.

—————————

10,000 Foot View – The US Hospital Market Segmentation

When it comes to the US Healthcare Market Segmentation, many people assume that this only refers to the hospital market.

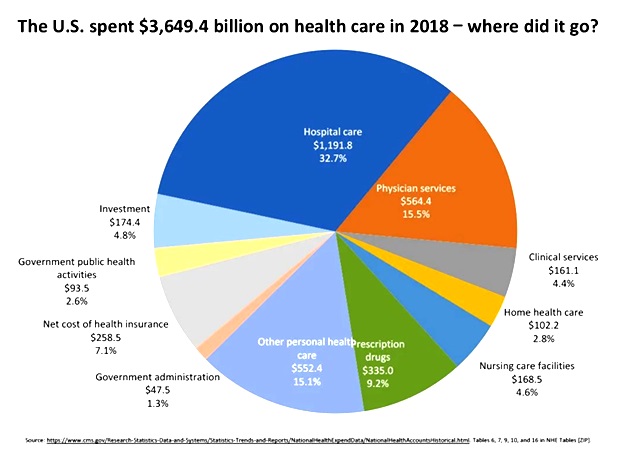

As shown in the pie chart at the start of this article, hospital care is the largest segment, accounting for 33% of the market and around $2 trillion.

As captured above, the vast majority of hospitals are part of one of 637 healthcare systems. In the next section, we will dive deeper into these.

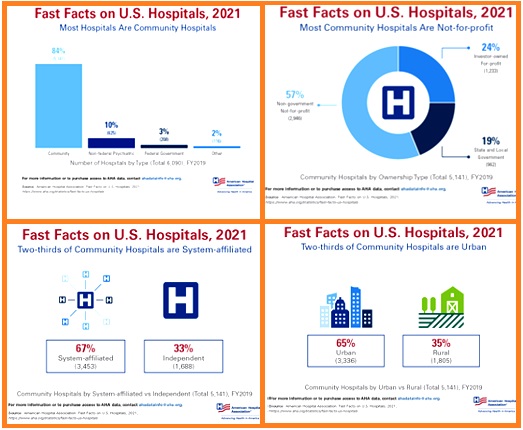

Here are some quick statistical facts from the American Hospital Association regarding the US hospital market

As you can see, US hospitals are mostly Community hospitals, in urban locations, part of a healthcare system, and not-for-profit.

Their minority are for-profit rural hospitals, government-run, and independent hospitals.

According to IBISWorld, US Hospitals employs over 5 million people including around 300,000 physicians and around 2 million registered nurses.

Bear in mind that these numbers are for hospital-based organizations. Therefore, many of these clinicians actually work in healthcare system Practice Groups and Ambulatory Facilities.

—————————

1,000 Foot View #1 – Anatomy of A Hospital-based System

According to the Agency for Healthcare Research and Quality (AHRQ), there are 637 healthcare systems in the US.

What surprises many who are learning about the US Healthcare Market for the first time is the size of some of the healthcare organizations.

The Top US Healthcare Systems

Becker’s analysis of 100 of the largest hospitals and health systems in America, provides a great overview of some of these vast organizations.

Industry consolidation, mergers, and acquisitions have been a growing trend for the last 10-20 years.

Further, changing dynamics have made it increasingly hard for hospitals to remain independent, and this has, therefore, driven larger systems to acquire additional scale and capabilities.

Take, for instance, the Chicago-based CommonSpirit Health. This faith-based organization runs 137 hospitals and care centers in 21 states.

It came about as a joint combination of Catholic Health Initiatives and Dignity Health. At the time of its launch, the health system had 150,000 employees and 25,000 physicians.

In FY 2020, their reported operating revenues were $30 billion with EBITDA of 2.1% (excluding the CARES Act)

In analyzing the US healthcare market segmentation, it is important to note that most healthcare systems are smaller and regional. RWJ Barnabas Health is a good example.

It is the largest integrated health delivery system in New Jersey providing treatment and services to more than 3 million patients each year.

This healthcare system is a product of the merger of two healthcare organizations, RWJ and Barnabas Health.

This healthcare system is a product of the merger of two healthcare organizations, RWJ and Barnabas Health.

Before joining forces, the two organizations had been highly acquisitive.

Currently, RWJ Barnabas Health has 13 hospitals including a teaching hospital and a pediatric facility.

The health system also has dozens of ambulatory and specialist facilities.

RWJ Barnabas Health has 35,000 employees which include 9,000 physicians.

This map shows their geographic footprint and how it serves a third of all New Jersians

1,000 Foot View #1 – Anatomy of A Hospital-based System

As referenced above, there are 136,000 Physician Groups in the US.

Although the majority are small practices, each of the 24,000 group practices employs over 50 physicians. These are typically multi-location and often with multi-specialty practices.

In addition to physicians, they also employ multiple physician extenders including nurse practitioners and other clinicians who can deliver the needed medical procedures.

A good example of such a practice is Austin Regional Clinic.

This is a multi-specialty group that has 400 providers.

It delivers 21 specialties across 33 locations within the Austin area of Texas.

—————————

The Final Word – The US Healthcare Market & New Entry

I hope this US Healthcare Market Segmentation, healthcare industry market segments analysis has been helpful. In order to paint the current picture, I’ve endeavored to use up-to-date and accurate information.

My aim is to make this the kind of article I would have found valuable when I started my journey in healthcare a decade ago. You can read a bit about my story at the bottom of this page. Let us know if you need help with your market entry strategy.

Lastly, if you are thinking about entering the US healthcare market, we can help. You can learn more about our services here.

You may enjoy this case about how we successfully helped a digital media company to enter the US market.